Golden days of “Bahar Azadi” gold coins on Iran’s stressed market!

Market News

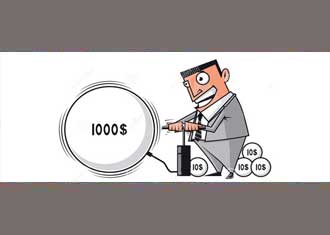

– The Central Bank of Iran announced the halting of Gold coin presales with different maturities, stressing that there is no limitation with regards to the nation’s gold reserves; this body is determined to continue its oversight over the market and in case needed, it will intervene either through auctions or presales. Over the last few days “Baha Azadi” gold coins hiked meteorically and prices reached IRR 22,000,000 level. It seems that USD speculation demand is now directed to gold market and the CBI decision is to put a cap on that for now.

– Following the forex rate unification implemented since the past month, the government has announced its commitment to meet all needs for hard currency, which includes those that exceed the previously-set caps; the NIMA platform is also under progress and is planned to address all FX needs of businesses in a short time. Just after the news, an official in CBI announced that home appliance producers will be entitled to have USD/IRR rate of 42,000 for their raw materials imports.

– Stressing on Iran’s stronger economy infrastructures as well as companies’ solid financial grounds and therefore, Iran capital market’s higher profitability contrary to previous years, the head of the Securities and Exchange Organization (SEO) of Iran said that the US withdrawal from the JCPoA will not damage the market security. Tehran Stock Exchange and Iran Fara Bourse have the habit of pre-digesting disappointing news and that is the main reason for last 2 weeks free fall of the market!

In the Market

Iranian equities rallied today after passing “the rock bottom” and recouped a tiny part of their previous weeks’ losses. Largely thanks to their mega caps, TEDPIX (0.34%) jumped 315 points and stood above 93,000 level again while IFEX performed amazingly and hiked 2.21%.

Nearly the entire Metals group saw positive trades with many names hitting their highs; the competition over products of the Esfahan’s Mobarake Steel products in the IME attracted investors’ attention to this share. Besides, the pellet production unit of Khorasan Steel was inaugurated with President Rouhani’s visit to Neishabour; it will annually produce 2.5 mn tons of pellet. Zangan Zinc Industry returned to the market at IRR 9,145, 9% higher. Positive sentiment dominated the Iron Ore group as well.

The rise in global oil prices directed attention towards the Oil Products space, in addition to the forex rate unification scheme.

The majority of names in the Chemicals industry also finished above their flat lines. Pentane and Hexane production units will be launched in Kermanshah Petrochemical Company in the near future; the ticker was planned to reopened, but it did not happen.

The Automotive space settled in the green with Iran Automobile Spare Parts and Electric Khodro Sharq hitting their highs. Despite President stress on divesting the government share in Iran Khodro and Saipa companies, the Minister of Industry, Trade and Mining announced that such will not be possible unless the number of rivals in Iran’s automotive industry increases; this can negatively affect those companies’ share prices.

As was said above, home appliance producers will be provided with the USD/IRR at IRR 42,000 for importing their required raw materials from today. In the next phase, the forex needed for importing prepared goods will be provided. The Machinery & Equipment space settled with slim gains.

Source:

2018, Golden days of “Bahar Azadi” gold coins on Iran’s stressed market!, Monday,May 07, p.1,<https://agahgroup.com>