TEDPIX Ends Trading Week 2.5% Higher

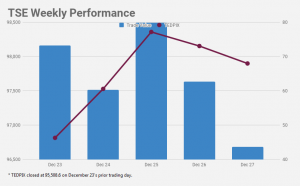

TSE’s main index TEDPIX jumped 2,391 points or 2.5% during the week that ended on Dec. 27 to close at 97,899.2.

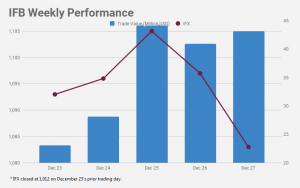

The benchmark index of the smaller over-the-counter exchange Iran Fara Bourse gained 0.8 points or 0.1% during the week to stand at 1,082.6.

TSE bulls faced benchmark correction on Tuesday after hitting an all-time high of 98,358 the day before.

Further pressure mounted on Wednesday and lowered TEDPIX to below 98,000.

IFB also followed a similar pattern and rushed to 1,105 on Monday only to shed 22 points in the next two days.

Global markets’ holidays and companies’ upcoming nine-month performance reports were the main reasons behind the stocks’ Tuesday and Wednesday decline, according to the Persian daily Donya-e-Eqtesad, with primary market drivers such as base metal producers, miners and refineries snapping their upward momentum.

Even copper and crude oil’s post-Tuesday record-breaking growth could not stem the sale tide. Copper crossed $7,200 and crude broke past $60.3–the highest in two and a half years–this week. The positive effect of commodities’ growth will most likely boost next week trade.

The forex market was also up this week, as USD gained 0.21% to reach 42,030 rials. This is the greenback’s highest against the rial in about two weeks and is bound to further boost capital market’s exporting firms.

Euro was on an even sharper trajectory as it grew 0.93% to 50,640 rials during the week to reach its 18-day high.

Over 5.2 billion shares valued at $318.2 million were traded on TSE last week. The number of traded shares and trade value dropped by 26% and 14.1% respectively compared to the previous week.

Trading at Iran’s stock markets starts on Saturday and ends on Wednesday.

TSE’s First Market Index gained 1,433 points or 2.1% to end at 69,550.1. The Second Market Index rose by 6,495 points or 3.22% to close at 208,420.9.

At IFB, with a 23% share of weekly trade, base metal shares were the market leaders, followed by chemicals with 22%, and transportation, storage and communications with 6%.

More than 1.55 billion securities valued at $179.7 million were traded at the over-the-counter exchange. The number of traded shares and trade value shrank by 30% and 71% respectively week-on-week.

IFB’s market cap gained $211 million or 0.7% to reach $29.56 billion.

Its First Market witnessed the trading of 199 million securities valued at $8.9 million, indicating a 40% and 35% drop in the number of traded securities and trade value respectively.

About 722 million securities valued at $44.9 million were traded in the Second Market, with the number of traded securities and trade value shrinking by 27% and 26% week-on-week respectively.

Over 3 million debt securities valued at $68.5 million were also traded at IFB, dropping 85% and 86% in the number of bonds traded and their value respectively.

Exchange-traded funds, however, picked up 33% and 5% in the number of shares traded and value to reach 127 million worth $32.09 million.

Housing mortgage rights’ trade was similarly on the rise, reaching 400,000 securities worth $7 million, up 25% and 24% respectively.

source:

2017, TEDPIX Ends Trading Week 2.5% Higher, Saturday, December 30, p.1,<http://www..financialtribune.com/>