Iran Banking Sector to Expand Ties with International Peers!

Market News

* Admitting to hurdles with which Iran Banking Sector is faced in actively working with major international players, which have also kept Iranian banks behind their international counterparts, including adhering to Anti-Money Laundering rules and Fighting Terrorism Finance frameworks as well as Basel Committee Standards, Iranian officials have announced the establishment of 800 correspondent banking relations with nearly 300 foreign banks since the JCPOA was struck. With the continuance of similar attempts along with time, the cooperation level is expected to improve.

* Following restrictions on some companies and traders by Chinese financial institutions that resulted in some bank accounts’ closure, which was claimed by Chinese authorities as the result of severely adhering to anti-money laundering rules, a meeting is to be held next week between the representatives of the private sector and the Foreign Minister, Mr. Zarif and his deputy to discuss the matter and find solutions to resolve it. In this regard, the Chairman of Tehran Chamber of Commerce insisted on Iran’s taking a more active diplomacy to tackle this issue.

* The Central Securities Depository of Iran (CSDI) announced the issuance of 102 and 92 trading codes for Individual and institutional foreign investors during 2017, reaching the total issued trading codes in Iran’s Capital Market to 979.

* Based on the Trade Promotion Organization of Iran announcement, 53% of total exports of the country ($31.6 bn) over the 3 quarters ended Dec. 21st is made up of non-oil exports to countries, including China, the UAE, Iraq and South Korea.

In the Market

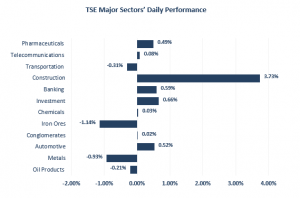

Over the past week, the market witnessed a great deal of emotion and irrational behaviors, which gradually faded away such that a rather balanced sentiment dominated the market in the current week; this was also coincided by the SEO attempts toward more transparency in the capital market, unfamiliarity with which rose concerns among shareholders to some extent. The high probability of hopeful upcoming Q3 financial reports, on the other hand, is one factor shifting the market atmosphere.

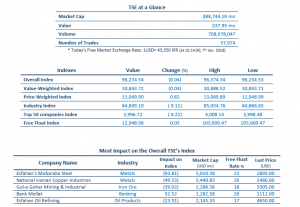

At the end of today’s session, heavy weighted names like Esfahan’s Mobarake Steel (FOLD1) and Persian Gulf Petrochemical Industries (PKLJ1) dragged the All-Share Index into the red, while the Weighted All-Share Index stayed 140 points higher.

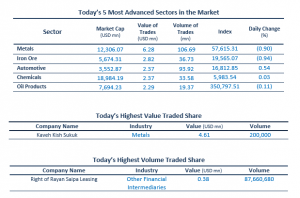

The Metals group experienced positive trades led by Esfahan Steel (ZOBZ1, +4.6%); the rumor of the company purchase by Esfahan’s Mobarake Steel re-directed attention to this ticker.

Left behind the major sectors’ recent growth, the Food and Beverages and Construction spaces saw demand rise. Nearly all names in the latter hit their highs, led by Maskan Investment (MSKN1). Having distributed IRR 36 as dividend, Maskan-e Zayande Roud Investment (ZNDZ1) ticker returned to the market going up by 12% at IRR 1,200. Rather similar atmosphere was seen in the Cement group.

The Automotive group went through positive trades with Indamin Shock Absorber, Iran Radiator and Nirou Mohareke as its top gainers. An auction announcement was made where Iran Khodro Development Investment (GOST1) is divesting a 20% of its share in Niroo Gostaran Company worth IRR 30 bn, putting Iran Khodro (IKCO1) and Iran Khodro Development Investment at the center of attention.

Source:

2018, Iran Banking Sector to Expand Ties with International Peers!, Sunday, January 7, p.1,<http://agahgroup.com/>