New corporate Sukuks on Iran Fara Bourse!

Market News

* Tejarat Kousha Sepahan, a private joint stock company active in railway transportation, succeeded to surpass the initial stages of issuing corporate Sukuk Istisna on Iran Fara Bourse to cover its IRR 768 mn (cUSD 17.64 mn) need of capitalization providing the company with 300 new Freighter wagons. These new securities have a maturity of 4 years with a nominal rate of 16%.

* In its latest research, the Majlis Research Center estimated Iran Economy to experience a 4.1% growth with a 10.5% inflation in the current year ending late March 2018. This body also set the average price of Iran’s oil at $55. To be more specific, this body has forecasted 3.8%, 3% and 5% growth for the Agriculture, Oil and Industrial sectors, respectively; furthermore, the Construction and Services spaces seem to go through 8.3% and 5.9% growth.

In the Market

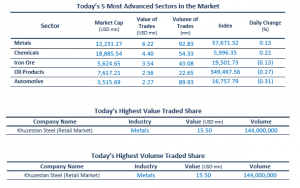

Except from Bank Eqtesad Novin (NOVN1) which closed the session below 4%, the Banking group settled with balanced trades, led by Bank Mellat (BMLT1). Bank Saman and Bank Refah held their AGMs with their financial statements approved; the latter is to raise its capital soon. In addition, with some experts proposing getting tax from savings accounts, the Central Bank of Iran announced its disagreement.

The news of a 5% rise in home appliance prices dragged tickers in the Machinery and Equipment space into the green. Sarma Afarin (SRMA1), Pars Khazar (KHAZ1) and Technotar (TKNO1) touched their ceilings.

Following the positive EPS adjustment in Iran Mineral Processing, whose ticker got halted and will be re-opened over the next session, zinc-based names in the Metals (Zarin Ma’dan Asia (KZIZ1) and Zangan Zinc Industry (ZAGZ1)) and Iron Ore (Bafq Mines, BAFG1) groups saw a demand rise.

The Computer group witness a warm welcoming from investors with Kharazmi IT Development (KARZ1), Iran Arqam (IAGN1) and Dade Pardazi Iran (DADE1) hitting their highs.

Source:

2018, New corporate Sukuks on Iran Fara Bourse!, Monday, January 8, p.1,<http://www.agahgroup.com/>