Justice Shares Finally Pays Off!

Market News

* The Chief of Privatization Organization of Iran announced that the first part of the Justice Share Scheme profits equal to IRR 12,000 bn will be paid off from today, in a four months period, to shareholders in position of IRR 10,000,000 worth of shares or be of the two low income brackets earlier defined. With 49 companies available in the project portfolio currently, more than 49 mn people will be eligible to receive this profit. The rest will also be settled before the current year ends. According to this scheme, 40% of total value of divestible companies in each market, as the subject of the second law of Principle 138 of the Iranian constitution and Article 9 of the 4th Development Plan, were decided to be allocated to the 6 low-income quartile of the country. In addition, a 50% discount in shares’ prices within a 10-year repayment period, with priority being given to villagers and nomads, was approved for the two lowest brackets.

* Referring to the need to 14,000 kilometers of new railway tracks by 2022 set by the Sixth 5-Year Development Plan, the Minister of Roads and Urban Development announced the upcoming delegation of a large part of this project to Khuzestan Steel Company. Esfahan Steel has already joined this project (in November 2016) promising the delivery of 40,000 tons of rails by the end of the current year (March 2018).

* An Iranian delegation is to pay a visit to India on January 16th to negotiate the lowering of duties on Iranian agricultural products, mostly aimed at signing a preferential trade agreement with this country, after New Delhi announced a 50% import tariff for the said goods.

* Releasing its monthly performance report for the period ended December 21st, Saipa announced the production of 45,551 vehicles, 19,867 of which were Prides. The company has also made IRR 9,404 bn over the said period. In terms of its Q3 activities, Saipa Company has produced 333,018 vehicles and made IRR 75,365 bn as sales revenue.

In the Market

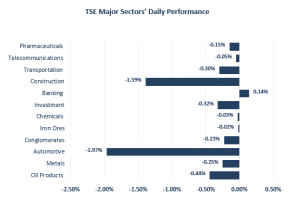

The more we approach the US President speech on its commitment to the JCPOA, the more conservation is felt in the market, resulting in many tickers finishing beneath their flat lines. The Chemicals group saw positive trades, led by Zagros (PZGZ1), Maroon (PMRZ1) and Kharg (PKHA1) Petrochemical companies, influenced by higher methanol prices. With IRR 1,820,000 mn in capital, Petrochemical Industries Investment (PETR1) positively adjusted its EPS estimates by 137%, from IRR 40 to IRR 95 based on its H1 performance; the company made IRR 9 over the said period.

According to the company officials, although in low volume, Iran Combine Mfg. Company (COMB1), listed on the Machinery & Equipment group, has exported agricultural machinery to Iraq, Uzbekistan, Tajikistan and Kazakhstan since the beginning of the current year, worth nearly $500,000. As the CEO has said, 70 combine machines are being monthly produced, while it used to stand at 30 in the year before and it has forecasted the production of only 703 vehicles in its current year’s budget; in case this trend continues, something around IRR 130 will be added to its estimated IRR 79 EPS.

It has been heard that a consortium of spare part mfg. companies is planning to purchase Iran Khodro block share. Despite the dominating negative atmosphere in the Automotive sector, some spare part mfg. companies like Iran Radiator (RADI1) and Iran Lent (LENT1) managed to end the session with good gains.

Iran Mineral Processing (FRVR1) returned to the market going up by 6.3% at IRR 15,500, leading the Metals group. Zinc-based tickers still run the sector hitting their highs. Rather similar sentiment dominated the Iron Ore industry with Damavand Mineral (DMVN1) facing a buy queue in its final trade.

Source:

2018,Justice Shares Finally Pays Off!, Tuesday, January 9, p.1,<http://www.agahgroup.com/>