Islamic Treasury Bills again on Iran Fara Bourse!

Market News

– Today a new piece of Iranian Islamic treasuries worth IRR 19,000 bn (cUSD 434 mn) offered to public on Iran Fara Bourse. Aiming to settle another part of administration’s debts, the new securities priced at IRR 769,367 a piece which made the YTM to be 15.36% and the BEY to be 14.37%. This is the first set of ITBs after a while with a maturity of two years.

– Quoted from an Iranian treasury department official, on Thursday December 11, a credit agreement of USD 6 bn will be inked between Iran and Italy letting the Italian companies to invest on Iranian projects. It seems that there are going to be two Iranian banks along with a national Italian holding to open the credit lines.

– After bills aimed at making amendments to the current Anti-Money Laundering and Fighting Terrorism Financing laws were submitted to the Majlis in November, the draft of the bill pertinent to the former was approved by the Majlis Judiciary Commission. The reforms targets shortfalls with regards to weaknesses in punishments efficiency and deterrence as well as the non-proportion between crimes and punishments.

In the Market

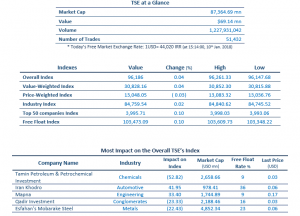

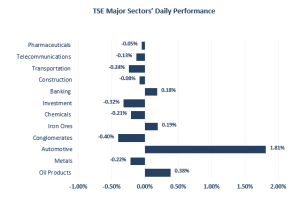

Lower supply of metals mostly zinc plus lower US oil reserves have yet kept commodity prices up along with a great number of names in Iran’s commodity-based capital market in the green, although concerns raised over whether the US president will remain committed to the JCPOA added to the selling pressure in the market.

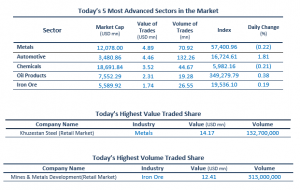

Leading the Metals space, Zangan Zinc Industry (ZAGZ1) returned to the market at IRR 6,500 with a buy queue with some other names going through positive trades. Esfahan Steel (ZOBZ1) has been heard to send 5,000 tons of finished goods to England as well as being in negotiations with British buyers to ink more contracts. It is also the first Iranian company receiving the Cares Certificate for its billet and rebar; this certificate will help the company achieve its export targets at the end of 2018. The company has also exported 1.5 mn tons of products over the first 8 months of the current year mostly to Qatar, Sudan, Egypt, Belgium and Pakistan.

Despite their rather weak trades, the Automotive space started to see more demand in the mid hours; this was interpreted by some as optimism among investors about the US President speech on Friday. The reason behind such positive movement also comes from the tax exemption on capital raise from asset re-valuation; Iran Khodro Development and Iran Khodro went up more than 4% with several spare part mfg. companies closing in the +3% zone.

A positive sentiment was also seen in the Other Intermediaries group led by Rayan Saipa (RSAP1) and Mellat (VLMT1) Leasing companies.

Names in the Banking and Investment groups also settled with moderate gains with Sobhan Investment facing a buy queue early in the session.

Source:

2018,Islamic Treasury Bills again on Iran Fara Bourse!, Wednesday, January 10, p.1,<http://www.agahgroup.com/>