Treasuries keep coming on Iran Fara Bourse!

Market News

– A new issue of Islamic Treasury Bills offered today on Iran Fara Bourse to complete another piece of government debts settlement. TB131 priced at IRR 921,030 and will be matured in a year. The YTM and BEY of this new securities are 16.5% and 15.6% respectively.

– A Master Credit Agreement worth 5 bn euro was signed between Bank of Industry & Mine and Middle East Bank (as the Iranian party) and Invitalia Global Investment (as the Italian party), focusing on opening lines of credit to finance investment projects, mostly in areas like infrastructure, oil and gas, power generation and petrochemical by Italian companies. It has been stated that both governmental and private sector projects can use the facilities, having received the required permits and respected the standards and priorities.

– Bank Pasargad and Bank Parsian have applied for opening up a branch in India with Bank Saman having sent its application for establishing a representative office in that country. Such a presence mainly seeks the receiving of crude oil purchased by India in addition to expanding ties with it.

In the Market

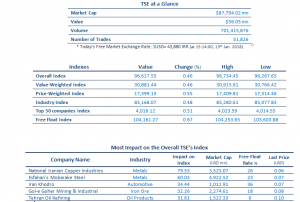

Finally the US president waived sanctions for another 4 months, resulting in a more positive sentiment in the whole market with the All-Share Index (Both Tehran Stock Exchange and Iran Fara Bourse) growing by 440 points.

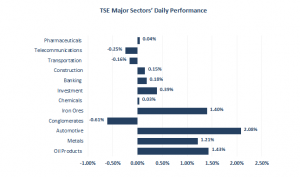

As the result, the Automotive sector saw a rise in demand with Iran Khodro Development Investment (GOST1) and Charkheshgar (CHAR1) facing buy queues.

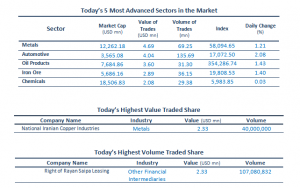

Influenced by the growing global commodity prices, the Metals and Iron Ore sectors went through positive trades, led by Esfahan Steel (ZOBZ1, +0.46) and Iran Zinc Mines Development (ROOI1, +2.54%), respectively.

An MoU was signed between Iran and India on long-term supply of locomotives to the country by India. Furthermore, another MoU was inked between the said countries on buying 200 locomotives and cargo wagons from India in a way that parts of those locomotives will be produced in Iran. Financial sources required equal $600 mn.

According to the Iranian Mines and Mining Industries Development and Renovation Organization (IMMIDRO), 258 mn tons of mineral products have been exported over the first 9 month of the current Persian calendar year (March-December).

The rise in global oil prices put the Oil Refining sector on an ascending trend, led by Tehran Oil Refining (PTEH1, +1.93%). Furthermore, Lavan Oil Refining (PNLZ1, +1.25%) has announced the realization of IRR 573 EPS over the first half of the current year, registering an 8% decline in comparison with the same period last year; it has also covered 48% of its estimates.

Based on official statistics, foodstuff worth $2 bn has been exported from Iran mostly to Iraq and Afghanistan over the 8-month period of the current Persian calendar year (March-November), posting a 20% rise in comparison with the same period last year. Except from a few tickers like Pegah-e Azerbaijan-e Qarbi (SHPZ1, +4.26%) and Gaz-e Seke (GSKS1, +4.98%), a rather negative atmosphere was observed in the Food & Beverages group.

Source:

2018,Treasuries keep coming on Iran Fara Bourse!, Saturday, January 13, p.1,<http://www.agahgroup.com/>