18% Sukuk Musharaka on Iran Fara Bourse!

Market News

– Iran and East leasing company is to issue new corporate Sukuk Musharaka on Iran Fara Bourse from Monday (Jan 15th) with a nominal rate of 18%. This securities worth IRR 240,000 mn (cUSD 5.5 mn), will be mature in 48 months and have monthly coupon payments. The raised capital from this offering will be used to finance housing facilities department. As of today there are 29 Sukuk securities trading on both TSE and Iran Fara Bourse markets. It shall be noted that since the first day of Sukuk issuance on Iran’s Capital Market, there were 18 corporate issues worth IRR 16,000 bn which have been settled right on time.

– Islamic Parliament Research Center of Iran announced the total amount of government debts. According to this report, the whole figure of administration and related entities’ debts is IRR 6,250,000 bn (cUSD 142.7 bn) as of June 2017, of which 57% is dedicated to government itself. The state owned firms liabilities shrank from IRR 4,020 bn to less than IRR 3,550 bn in a three month period from April to June 2017.

– Over the previous session on Iran Mercantile exchange, more than 9,400 metric tonnes of edible wheat were traded on the exchange agriculture floor. Moreover, near 7,986 tonnes of corn in form of guaranteed purchase agreement along with 700 tonnes of raw oil were traded on IME in first day of the business week.

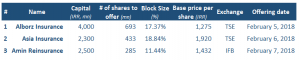

– Iranian Privatization Organization is to divest the shares of three major Iranian insurance companies in public offerings pursuant to Article 44 of the nation’s constitution. The below table shows the details of to be offered deals:

Another day, another green!

In the Market

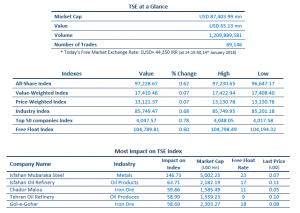

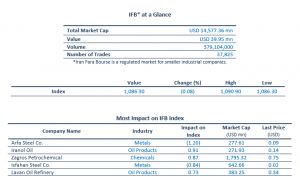

Stocks ripped to record highs for the second day in a row on today’s session, extending their fantastic start to 2018. The TEDPIX rallied 0.62% to 97,228.67 and the IFEX slipped for only 0.08 % to 1,086.30. The equity market was slightly higher at the opening bell and climbed pretty steadily throughout the day, finishing the good day in green.

Isfahan Mubaraka Steel (FOLD1, +2.71 , IRR 4,839), Isfahan Oil Refinery (PNES1, +2.70, IRR 4,839), Chador Malou(CHML1, +3.50, IRR 2,099) and Tehran Oil refinery (PTEH1, +3.52, IRR 4,322) kicked off the fourth quarter earnings season on a mostly positive note as all four reported better-than-expected.

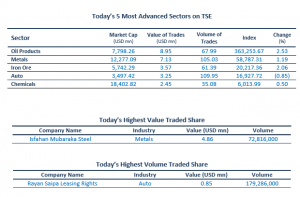

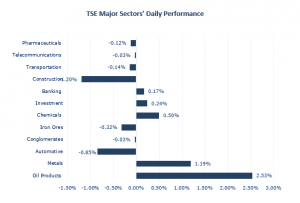

The Oil products sector was the top-performing group on today session with all of its tickers jumped between 0.2 to 5%. After recent indifference of market participants to USD/IRR rate, it is now the time for the companies to adjust their earnings with regards to the new rate.

It seems that a new wave of optimism is now dominant in the market and trades value and volumes are proof to this statement.

|

|

|

|

Source:

2018,18% Sukuk Musharaka on Iran Fara Bourse!, Sunday, January 14, p.1,<http://www.agahgroup.com/>