Iran’s Economy to Follow International Development Models

Market News

– World Bank forecasted Iran Economy to go through a 4% and 4.3% growth in 2018 and 2019, respectively; rather similar rate has also been proposed for 2020. Despite predicting higher investment growth, the estimated lower oil revenues intensified with more restrictions on having access to finance are said as the major barriers ahead Iran economy taking off. In this regard and with boom in the country’s growth in mind, the private sector has stressed on following the paths paved by other countries with currently notable economic achievements which have been in the same state before, such as China, South Korea and Malaysia.

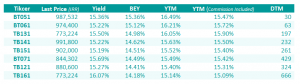

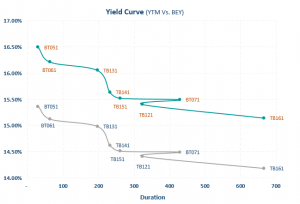

– The yield rates on Iranian treasury securities are now lower showing that the outcomes of CBI directive to put a cap on interest rates are in effect. The below table shows the latest status of Iran Debt Market, with regards to outstanding Islamic Treasury Bills, which is more diversified than ever.

– Tomorrow, the Iranian government is to issue IRR 10,000 bn (cUSD 227.3 mn) worth of Sukuk Musharaka on Iran Fara Bourse to pre-finance Tehran-Mashhad rail way electrification project. The new securities have a nominal rate of 17% per annum with semi-annual coupon payments and will be matured on 48 months. The national treasury is pledged for the clearing and settlement process.

– Following the 5 bn euro finance deal between Iran and Italy, one of the Iranian banks, i.e. Bank Middle East is now in charge of allocating the funds to the private sector and the other party, i.e. Bank of Industry & Mine will provide the public sector and the government with the funds, of course after the eligibility of the projects in both sectors are approved.

Corporate Earnings

Bank Karafarin has realized IRR 54 EPS in the 9-month period ended Dec. 21st, registering a 64% decline in comparison with the same period last year; the bank has covered 43% of its estimates over the said period. The bank has a) Lower effective rates on granted facilities, b) Higher NPLs and c) Higher cost of capital to blame for its worse than expected performance:

In the Market

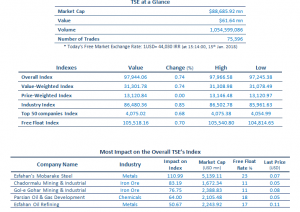

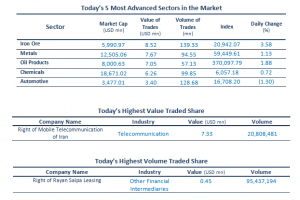

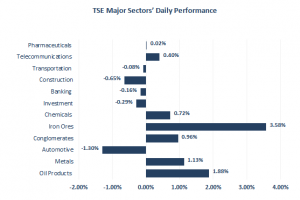

Influenced by oil price jump as well as other commodity prices roar, the majority of tickers in the Oil Products, Iron Ore and Metals spaces saw a rise in demand, with many hitting their highs.

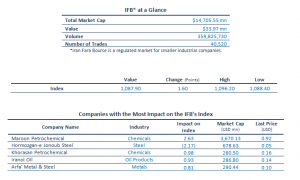

The National Iranian Copper Industries (MSMI1) ticker, in the latter, was halted; the company has positively adjusted its EPS estimates by 51% as the result of growth in global copper price and US/IRR rate. Over the first half of the current year, Esfahan’s Mobarake Steel (FOLD1), which today also led the Metals group, experienced a 235% growth in its operating profit, compared with the same period last year. The following are the most prominent incidents in the company’s consolidated financial statements: 39% rise in long term investments; 71% growth in retained earnings; 53% increase in operating income; 150% jump in gross profit; 298% hike in net profit along with 70% growth in operational cash flow. Furthermore, KIMIAY-E Zanjan Gostaran Mineral is planning to raise its capital by 245% from shareholders’ paid-in capital and retained earnings to build a 10 MW power plant.

Among the 37 industries in Iran’s stock market, the Sugar group has registered around 65% return since the beginning of the year to date. Led by Qazvin Sugar (GGAZ1), Sabet Khorasan (GSBE1) faced a buy queue nearly in the first hour.

Source:

2018, Iran’s Economy to Follow International Development Models, Monday, January 15, p.1,<http://agahgroup.com>