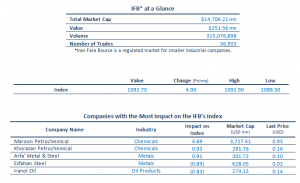

Iran Fara Bourse Hosted a New Ticker!

Market News

– In today’s session, 20% of Zagros-e Shahr-e Kord Milk and Meat Company, equal to 16,000,000 shares, went public in the second market of Iran Fara Bourse, listed on the Agriculture space, through the book building with its price ranges from IRR 3400-3500; each individual and institutional code was allowed to put orders up to 130 shares. According to the company’s financial statements, its sales over 2015 and 2016 grew up by 3 and 5%, respectively and it forecasted to see a 17% jump in its sales in 2017 to stand at IRR 500 bn, which seems possible in case milk prices continue to rise. With IRR 80 bn in capital, the company has estimated to realize an EPS of IRR 482 for the FY ending 21 March 2018 and it has covered IRR 205 over H1.

– Following several rounds of negotiations an in a meeting on Sunday between high-ranking officials from Central Bank of Iran and Turkey as well as executives from Ziraat Bank and Halkbank in Tehran, new venues to develop banking relations were discussed focusing on expanding economic ties. The currency swap agreement, which sought the reduction of costs for trades, finally inked on 20th of October was one step to further strategic cooperation, which will be operational soon since its required infrastructure is ready. With Bank Melli Iran’s account being opened with Bank Ziraat, other Iranian banks are also are in talks to do the same.

In the Market

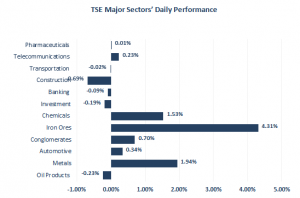

In the Metals space, led by MSMI1, the halted Zinc Mines Development estimated its new EPS to stand at IRR458, registering a 24% positive adjustment. Besides, National Iranian Copper Industries (MSMI1, +4.81%) returned to the market after its 51% EPS positive adjustment, 7% higher at IRR 2,692. As planned, Middle East Mining Industries (KHMZ1, +0.45%) is to launch a blast furnace next year; for this to happen, production lines of coke and coke coal have been built. The plan will end Esfahan Steel monopoly in producing coal.

In addition, Iranian steelmakers managed to produce 30 mn ton of steel, 16.07 mn ton of which were semi-finished steel followed by 14.63 mn ton of finished steel, over the 9-month period of the current Persian calendar year (March-Dec.), demonstrating a 12.5% rise in comparison with the same period last year.

Petrochemical companies listed on the Chemicals space saw significant demand this week, mostly influenced by rumors on the liberating of urea prices. Tamin Petroleum & Petrochemical Investment (PTAP1), Shazand Petrochemical (PARK1), Khorasan Petrochemical (PSKZ1) and Kermanshah Petrochemical (PKER1) hit their highs.

Finally, the Automotive space tickers started to trade positively with Iran Khodro Investment Development (GOST1) and Nirou Mohareke (NMOH1) facing with buy queues.

Source:

2018, Iran Fara Bourse Hosted a New Ticker!, January 16, p.1,<http://agahgroup.com>