Official Stats on Iran’s Economy Developments

Market News

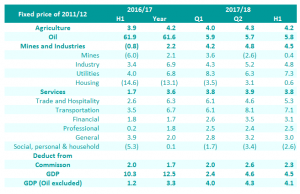

– On Sunday, the governor of the Central Bank of Iran (CBI) announced Iran’s Economy Growth in the first half of the current year. With a 4.6% growth in Q1 and a 4.4% growth in Q2, the country has gone through a 4.5% growth in the said period; previously, the Statistical Center of Iran had reported a 5.6% growth for the similar period; this report had announced Q1 and Q2 growth rates at 6.2% and 5.2%, respectively. The following table draws a picture of the experienced growth in the country:

– With regards to the Securities and Exchange Organization of Iran (SEO) attempts to approach the stock market to international standards in terms of removing the obligatory release of EPS forecasts, which has raised concerns among some experts, an official in the SEO announced that lifting that obligatory load sought the goal of shortening the halting period, since companies’ tickers used to remain halted until their EPS forecast had been submitted to this body, which resulted in the imprisoning of investors’ capital; in addition, it was stressed that issuers are able to release such information in their management commentaries. This official also announced ongoing attempts on removing base volume and setting a dynamic mechanism to define stocks’ fluctuation domain and stressed that they are determined to take steps towards global standards and more analysis-based trades.

In the Market

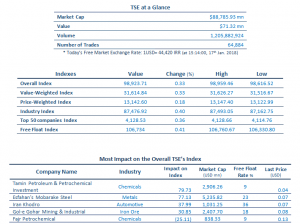

Stocks rocketed to a new all-time high record early on today’s session. The Tehran Stock Exchange index (TEDPIX) rose for 0.33% to stand at 98,923.53 level and break all its previous records.

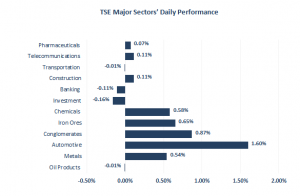

Eight of twelve major sectors finished today in positive territory with the Chemicals (+0.58%) and Metals (+0.54%) groups pacing the lead.

In the Metals group, Isfahan Mubaraka Steel (FOLD1) surpassed an important resistant level of IRR 3,100. Analysts believe that if the ticker holds higher in coming days, it has the potential to reach IRR 3,500 and then 4,000 levels. Zangan Zinc Industries ticker was reopened with a buy queue at IRR 8635. Iran Zinc Mines Development also returned to the market at IRR 3,561 with a buy queue as well.

Iran Pipe & Machinery has realized IRR 84 EPS over the 9 month period, covering 80% of its estimates while it had made IRR 299 loss per share in the corresponding period last year. Releasing its Q3 reports, Esfahan Steel Co. has also realized IRR 2 EPS while it had made IRR 221 loss per share in last year’s corresponding period; it has also covered 40% if its estimates in the said period.

With a 53% positive EPS adjustment, Neishabour Sugar, listed on the Sugar space, increased its EPS to IRR 160; comparing its recent report with its previous, despite a decline in sales, one sees a 37% rise in operating profit and 63% increase in its net income only by managing its COGS.

As was said in the other day’s newsletter, liberating domestic urea prices directed attention to tickers like Kermanshah, Khorasan and Pardis Petrochemical companies in the Chemicals industry. Kermanshah Petrochemical Industries has made IRR 359 EPS over the 9-month period ended December 21st, registering a 3% rise; the company has covered 73% of its estimates over the said period.

Finally, the majority of spare part mfg. companies in the Automotive industry settled with balanced gains. Iran Khodro (IKCO1) share block announcement was re-issued again, which as has been said before, only affects Iran Khodro Development Investment; both names ended in the +3 and +4% zones, respectively.

Source:

2018, Official Stats on Iran’s Economy Developments, Wednesday, January 17, p.1,<http://agahgroup.com>