Iranian Industries to Go Private!

Market News

– After 80% shares of Mellat, Saderat and Tejarat banks were divested to the private sector in mid-2000s to comply with Principle 44 of the Iranian Constitution, Iran Privatization Organization is now determined to divest the remaining state owned stakes as well, which has estimated to generate nearly $3.4 bn for the government; this, albeit, awaits the approval by the cabinet members. The privatization process will continue by offering shares of Louleh Gostar-e Esfarayen, which is active in the pipe manufacturing industry and Manjil and Roudbar Wind Farms.

– Stressing that the Central Bank of Iran (CBI) does not prefer state-owned projects over private sector ones in allocating the foreign credit, recently as the result of the 5 bn euro deal struck between an Italian bank and 2 Iranian banks, a CBI official stated that private sector companies will be able to get such a funds more easily since they are not required to provide guarantees from the Ministry of Economic Affairs and Finance.

Corporate Earnings

- With its projection to realize IRR 147 EPS, Iran National Lead and Zinc (SORB1) managed to make IRR 113 (covering 77%) in the 9-month period. The company has succeeded to materialize 70% of its sales while it had made 65% in the same period last year.

- Esfahan’s Mobarake Steel (FOLD1) managed to make IRR 491 EPS in its 9-month period, posting a 230% rise; the company has realized 90% of its estimates for its FY ending 21 March 2018.

- Iran Zinc Mines Development (ROOI1) has realized IRR 147 EPS, which demonstrates a 167% increase compared to its previous similar 9-month period. It has also covered 32% of its estimates over the said period.

- Releasing its Q3 reports ended December 21st, Khuzestan Steel (FKHZ1) announced the realization of IRR 735 EPS (out of estimated IRR 812), showing a 140% growth compared to the same period last year.

- Estimating to make IRR 5720 EPS, Zagros Petrochemical (PZGZ1) managed to realize IRR 4697 (covering 82% in comparison with the 56% in last year’s corresponding period) in its Q3 performance ended December 21st. the company’s sales and gross profits grew by 31% (to reach IRR 27543 bn) and 54% (10% rise compared with same period last year), respectively.

- Shiraz Petrochemical (PRZZ1) has recognized IRR 259 loss per share over the 9-month period ended December 21st, proving a 31% decline compared with last year corresponding period. The company had estimated to make IRR 45 EPS based on its H1 performance.

- Persian Gulf Petrochemical Industries (PKLJ1) has realized IRR 2 loss per share in the first half of the current fiscal year ended December 21st, which posts an 80% decrease in comparison with the same period last year. It is so while it had forecasted to make IRR 822 EPS.

In the Market

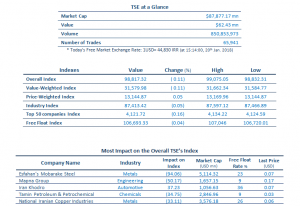

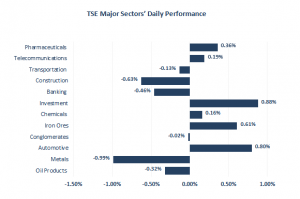

The Overall-Index finally entered the 99,000 channel in the first quarter of the session, which was not held through the closing bell; as has been previously stated, the current rise has been derived by global commodities price growth.

Continuing to be influenced by global prices hike, the Metals and Iron Ore groups went through positive trades. The Iranian ambassador to Oman announced the opening of bank accounts for Esfahan’s Mobarake Steel, Esfahan Steel, and Khuzestan Steel companies by Bank Sohar.

Tickers in the Automotive space started the session in a balanced and positive manner with Iran Khodro Investment Development (GOST1) and Iran Khodro (IKCO1) facing buy queues in the pre-opening phase; Iran Khodro’s 15.85% block share, i.e. more than 2.2 bn shares, will be offered by Samand Investment (owning 10.2%) and Negar-e Nasr (owning 5.6%) companies at IRR 4054 as base price on January 31st.

The Transportation group also saw a demand rise in the middle of the session, led by Rail Pardaz-e Seir (HRLZ1) and Sina Port and Maritime Services Development (SMBZ1) both hitting their highs. A passenger trains service has been decided by Iran and Pakistan’s officials to be resumed by September 2018, as the result of a meeting on Thursday.

Finally, nearly the whole Sugar space finished in the green with many closing with buy queues, including Qazvin (GGAZ1) and Esfahan (GESF1) Sugar companies.

2018, Iranian Industries to Go Private!, Saturday, January 20, p.1,<http://agahgroup.com>