SEO not to eliminate brokerages credit lines!

Market News

– “The recent directive by SEO addressing brokers to provide their clients on longer with credit lines was an absolute misunderstanding” said Rouh Allah Mirsanei the Secretary-General of Iranian brokerages association. He continued: “the previous customers credit lines bylaw is still in place and SEO is just to mitigate any unnecessary risks by simply recording each client credit history and eliminate probable adverse balance and delays in payments.” According to the SEBA Secretary-General, brokers can continue offering their customers with purchase credits like before.

– Tehran Stock Exchange once again placed first in overall return for the current Persian year (2017/18). The capital market recorded a performance of 28% over 10 months and stood tall amid other parallel markets. The gold coin placed the second with 25.1% following by USD/IRR with 21% hike. The recent jumps in Iranian markets are mostly due to a rise in FX rate along with better than expected performance in global commodity markets.

– Over the week ended on January 18, the trade value on Iran Mercantile Exchange rose for 19% contrary to the previous week figures. More than 601,483 tonnes of commodities worth IRR 13,309 bn (cUSD 292.50 mn) has been offered on IME during the period.

Tehran Stock Exchange settles lower following the SEO credit directive!

In the Market

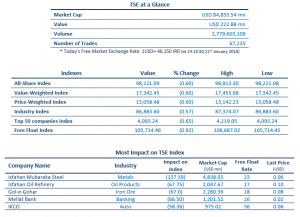

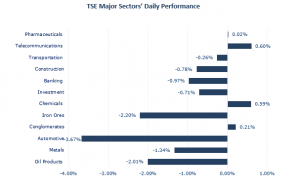

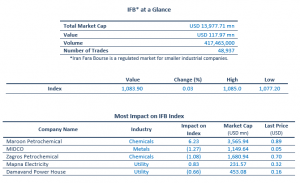

Stocks slid from their new records today as the SEO directive on customers credit lines made a state of incommensurability amid market participants. The TEDPIX fell for -0.60% to 98,221.09 while the IFEX (+0.03%) ended the day with a thin-ice gain.

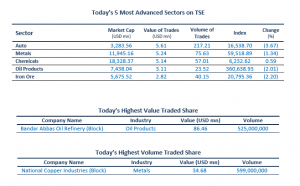

Trading ranges were pretty narrow for most of the day on the retail market, but a late wave of huge block sized buying left the trading volume and value at their record highs. Three blocks of Bandar Abbas Oil Refinery (PNBA4), National Copper Industries (MSMI2) and Isfahan Mubaraka Steel (FOLD2) together worth cUSD 155.4 mn.

The SEO credit drama did little to dampen the mood mostly for micro caps, which has been especially bullish since the start of 2018. The overall weighted average loose also -0.6% and lots of small sized tickers ended the day in sale pressures.

Within the Metals sector (-1.34%), the giant Isfahan Mubaraka Steel (FOLD1, -2.39%, IRR 2,977) was the top looser with near 18 mn traded shares. Other blue chips of the industry followed the lead made a red day after the sector’s recent gains.

Finally, the Auto sector (-3.67%) also underperformed in a poor show from its giant Iran Khordo (IKCO1, -4.91%, IRR 2,941) resulted by a worse-than-expected earnings and revenues for the fourth quarter. It is safe to say that almost all of the tickers ended the day in red following the disappointing profit margin reports for Q4.

2018, SEO not to eliminate brokerages credit lines!, Sunday, January 20, p.1,<http://agahgroup.com>